You can find both benefits and drawbacks to buying a rental property outside of the state. This article discusses the advantages and disadvantages of doing this. This article also discusses financing options. You have many options to finance your rental property. For advice and information on the market, consult a local realty agent.

Investing in a rental property outside of your state

It can be a good idea to invest in rental properties outside of your home state. Many people who live in expensive areas find there are more affordable properties in other locations. This could lead to a higher return for investors. This can help diversify your portfolio.

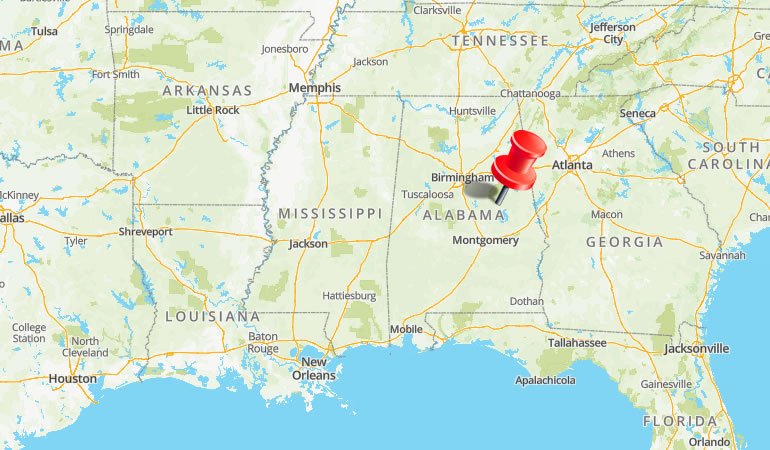

The geographical diversity is another reason to consider renting properties out of your home state. This is a huge advantage because investing in rental properties in multiple areas allows you to diversify your portfolio and protect it from total devastation in one region. Because each state, county, and town is unique, a market decline in one area may not have the same impact on another.

Challenges

Renting property out of state is a possibility for you, but the process can be hard. Even though out-of-state markets can offer better profits, you will need to spend more time understanding the area. To be successful, you should research the area online and work with a local property management company or real estate agent to find the best properties for rent.

If you want to diversify real estate portfolios, buying property out of-state could be a good option. But it can be time-consuming and costly.

Reward Program

Out-of-state rentals can offer many benefits. It diversifies your rental portfolio, and reduces the chance of total destruction in one location. Second, every state, city, and county has a unique economic system. This means that markets in adjacent areas may not be affected by a decline in one location.

Renting out your property can help diversify your portfolio and generate passive income. You should be aware of both the risks and the benefits of renting out your home. There are different laws governing landlord-tenant relations from state to state, even within the same state. These laws can have an impact on how landlords screen tenants and determine whether to increase rents or terminate lease agreements.

Financing options

If you plan to purchase rental property from outside the state, there may be additional hurdles to overcome in order to obtain financing. You can avoid these pitfalls by researching your financing options, getting pre-approved, and looking at properties before you make an investment. This will make it easier to find the right property, and reduce surprises.

Another option is to approach banks or other lending institutions. A bank or lending organization will be more accommodating if you have a solid track record as landlord and can prove you're a safe risk. Typically, a downpayment must be at least 25%. This will help you pay lower interest rates and lower debt-to-income ratio.

FAQ

How much money will I get for my home?

The number of days your home has been on market and its condition can have an impact on how much it sells. The average selling price for a home in the US is $203,000, according to Zillow.com. This

What are the chances of me getting a second mortgage.

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

How do I calculate my rate of interest?

Interest rates change daily based on market conditions. The average interest rate during the last week was 4.39%. Add the number of years that you plan to finance to get your interest rates. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

How can I determine if my home is worth it?

If your asking price is too low, it may be because you aren't pricing your home correctly. A home that is priced well below its market value may not attract enough buyers. Our free Home Value Report will provide you with information about current market conditions.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to find houses to rent

People who are looking to move to new areas will find it difficult to find houses to rent. However, finding the right house may take some time. When you are looking for a home, many factors will affect your decision-making process. These include location, size, number of rooms, amenities, price range, etc.

We recommend you begin looking for properties as soon as possible to ensure you get the best deal. Consider asking family, friends, landlords, agents and property managers for their recommendations. This will allow you to have many choices.