Buying a property with cash is a good way to save some money. This is not the best option for all.

Despite the increasing popularity of buying a home with cash, it's important to know the pros and cons before making the decision. You should also find out if your income qualifies you to buy a house with cash.

Can I Buy a House With Cash?

Buying a home with cash can be a great way to make sure you get the right house at the right price. You can save money by paying cash for your house. There are several advantages, including not having to pay a monthly mortgage, eliminating the interest payment and avoiding closing costs.

The buyer must be able provide evidence of sufficient funds, at least within a few days after an agreement is made - if not before signing the contract. The evidence could be a statement of bank or a written letter from the financial institution.

If a buyer makes a cash-only offer, he or she must be willing to put down a deposit as a guarantee of the purchase. This deposit is also called earnest money. This deposit should be a small amount, typically around 1% of the total sale price.

The amount for earnest cash deposit will depend upon the particular purchase. It is important to make sure that the seller accepts the offer and you are able to afford the home. The deposit will let the seller see that you are serious and act as a sign of good faith.

What Can I Do to Buy a Home With Cash

You may want to consider paying for your house in cash if you've got a lot of liquid money stashed away in accounts like savings, checking, and money markets. Cash can be useful to buyers who may have difficulty obtaining a mortgage or who wish to save in a market with high risks.

Having a large amount of cash can also be helpful if you have a thin credit file, which can prevent you from getting a mortgage. People who move back to the United States or have lived abroad can be affected by this.

You can buy a home you wouldn't otherwise be able. The price of homes is usually higher than the average income, so a lot of people struggle to find a home that they can afford with a mortgage.

A downside to buying a property with cash is the difficulty in predicting how long it will be before you can sell it. A contingent sale, such as one that depends on financing or an appraiser's report, can be risky because the loan may fall through or the house might not appraise.

Many sellers like the idea of receiving a cash payment because it reduces their risk and increases their certainty. A cash offer allows them to close the sale faster and with fewer moving pieces.

FAQ

What amount should I save to buy a house?

It depends on how much time you intend to stay there. You should start saving now if you plan to stay at least five years. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

What are the top three factors in buying a home?

When buying any type or home, the three most important factors are price, location, and size. It refers specifically to where you wish to live. Price refers to what you're willing to pay for the property. Size is the amount of space you require.

How much money do I need to purchase my home?

The number of days your home has been on market and its condition can have an impact on how much it sells. Zillow.com says that the average selling cost for a US house is $203,000 This

Should I use a mortgage broker?

A mortgage broker is a good choice if you're looking for a low rate. Brokers have relationships with many lenders and can negotiate for your benefit. Some brokers do take a commission from lenders. Before signing up for any broker, it is important to verify the fees.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

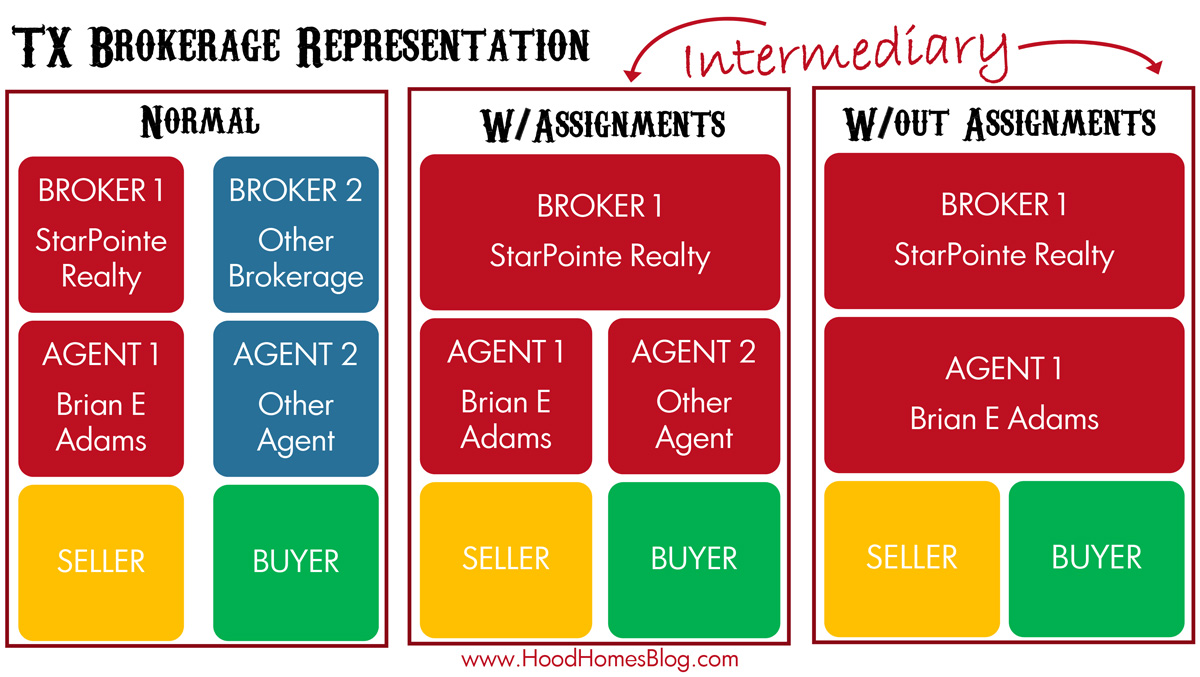

How to become a real estate broker

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This requires studying for at minimum 2 hours per night over a 3 month period.

This is the last step before you can take your final exam. You must score at least 80% in order to qualify as a real estate agent.

You are now eligible to work as a real-estate agent if you have passed all of these exams!