A short sale is when a lender agrees to let a property be sold for less than the mortgage owed. Although it is an option for homeowners who have financial difficulties, it can also be confusing.

Explain a Short sale: A Bank's process

Homeowners who decide to sell their house must provide their financial information. These documents can include paystubs and tax returns as well as bank statements and a hardship letter.

After the homeowner has made it clear to the lender that they can no longer afford their loan payments, it's time to submit a quick sale application. The homeowner will need to provide financial and personal information, along with a broker's opinion (BPO), or an appraisal.

The bank will review this information and decide whether to approve the short sale. If they approve, the house will be sold at a reduced price.

If a homeowner is not able to sell their home, the bank can then file a foreclosure on the property. This can be a very expensive and difficult process for both parties.

Explain a short sale: 2019 Buyers Process

When a buyer is looking to buy a short sale, they will need to be prepared for a long and complicated process. It will take longer for contracts to be negotiated and approvals to be granted than traditional sales processes.

For a short sale to be successful, it will take patience and understanding from both the buyers and the sellers. It will take time to close the deal, and ensure that all paperwork is in order.

The buyer must also be able and able make a substantial downpayment on the house to be approved to short-sale. The bank might refuse to accept the offer if they are unable to do so.

This can make it more difficult and costly to negotiate. It is essential that the buyer has a skilled real estate agent to guide them through this complex process.

A short sale is a good option if buyers are facing financial difficulties and need to sell their home. Although it is not easy to get a bank to approve a short sale, it is possible and will be beneficial for both the lender as well as the buyer. A short sale is an excellent option for someone who is trying to avoid foreclosure and looking for an affordable home to live in.

FAQ

What are the chances of me getting a second mortgage.

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

What should you consider when investing in real estate?

The first step is to make sure you have enough money to buy real estate. You can borrow money from a bank or financial institution if you don't have enough money. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

You also need to make sure that you know how much you can spend on an investment property each month. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

Finally, you must ensure that the area where you want to buy an investment property is safe. It would be a good idea to live somewhere else while looking for properties.

Should I rent or purchase a condo?

Renting might be an option if your condo is only for a brief period. Renting saves you money on maintenance fees and other monthly costs. However, purchasing a condo grants you ownership rights to the unit. You have the freedom to use the space however you like.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

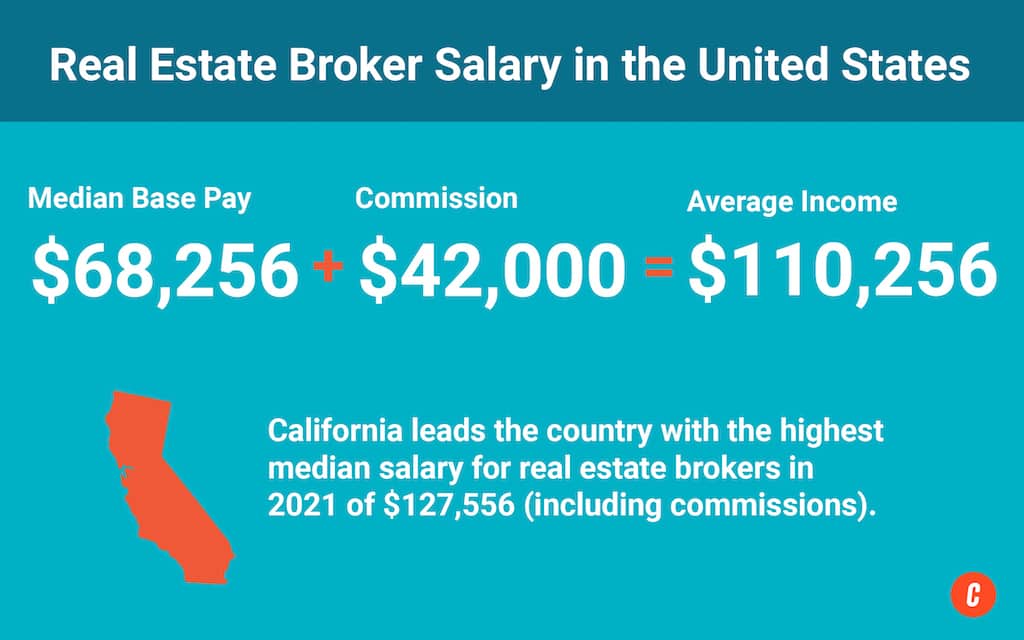

How to become a broker of real estate

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This requires that you study for at most 2 hours per days over 3 months.

Once you have passed the initial exam, you will be ready for the final. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

You are now eligible to work as a real-estate agent if you have passed all of these exams!